Multi-VAT

by N3 Vision AB

Just a moment, logging you in...

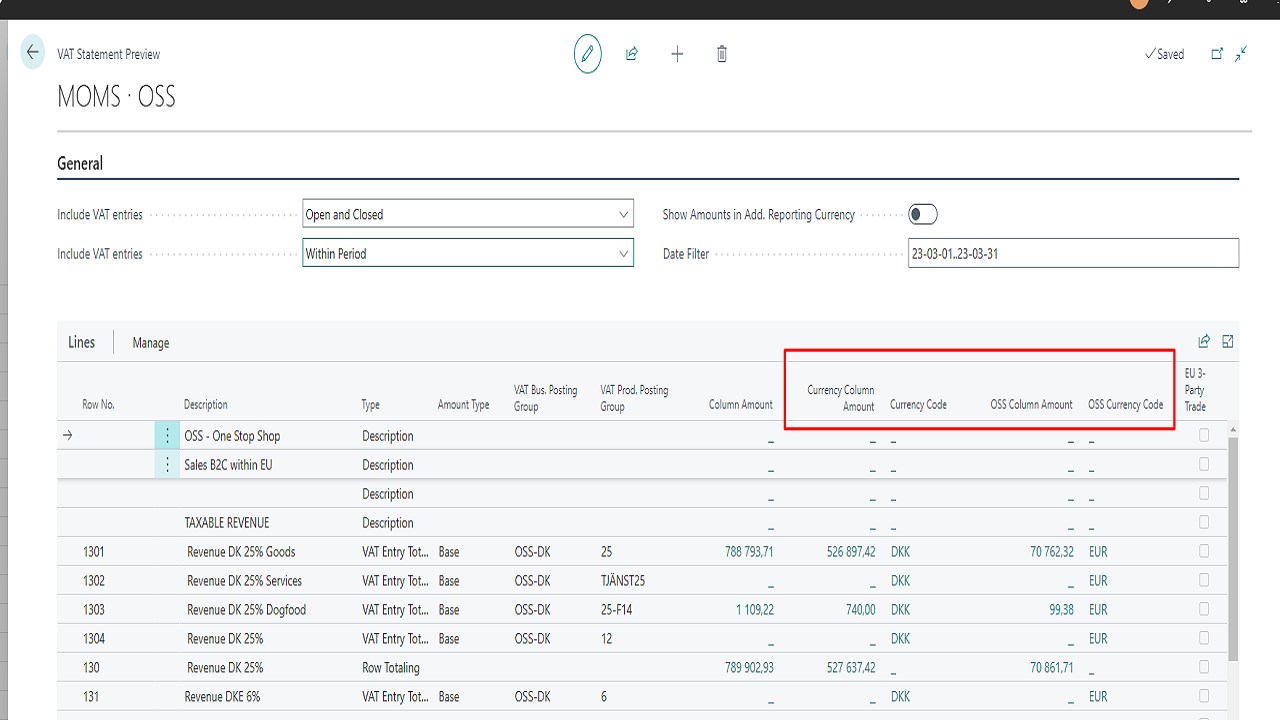

Report VAT for multiple countries and currencies

Multi-VAT is a Microsoft Dynamics 365 Business Central Add-On. It can report VAT in multiple currencies and for multiple countries, from within Business Central.

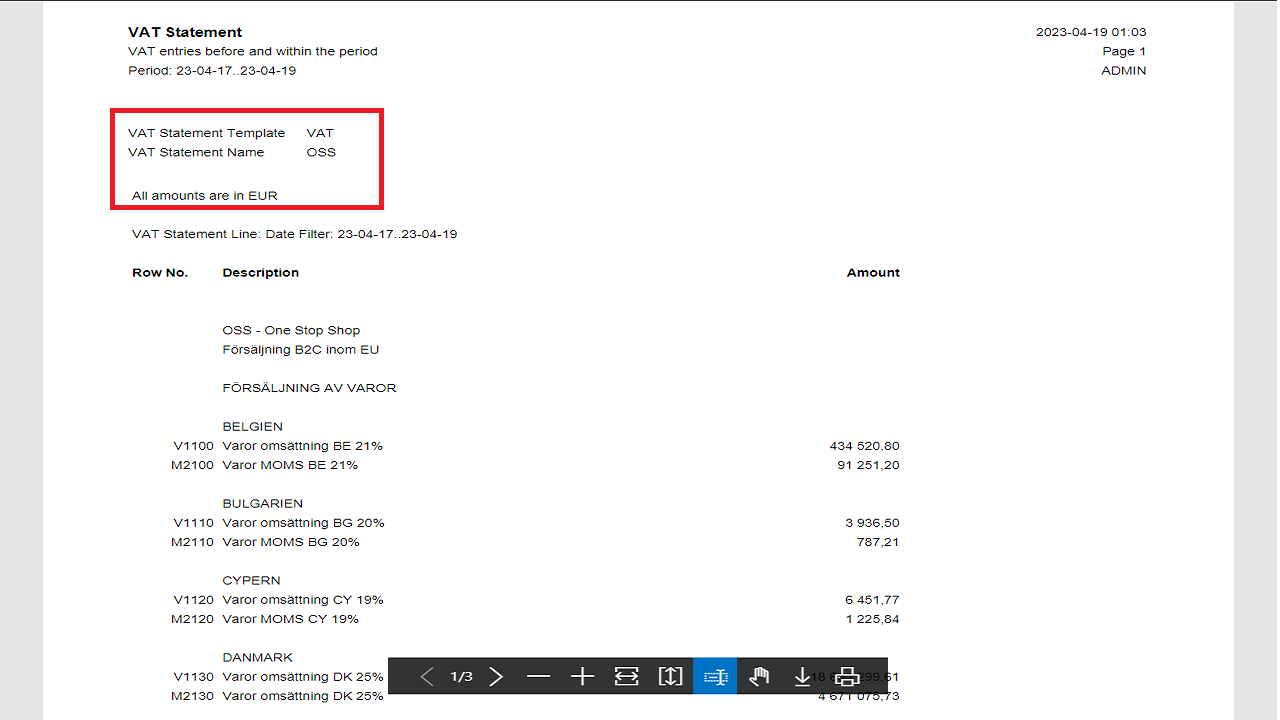

The solution also supports OSS VAT reporting for the European countries, with only one VAT Statement to handle and post.

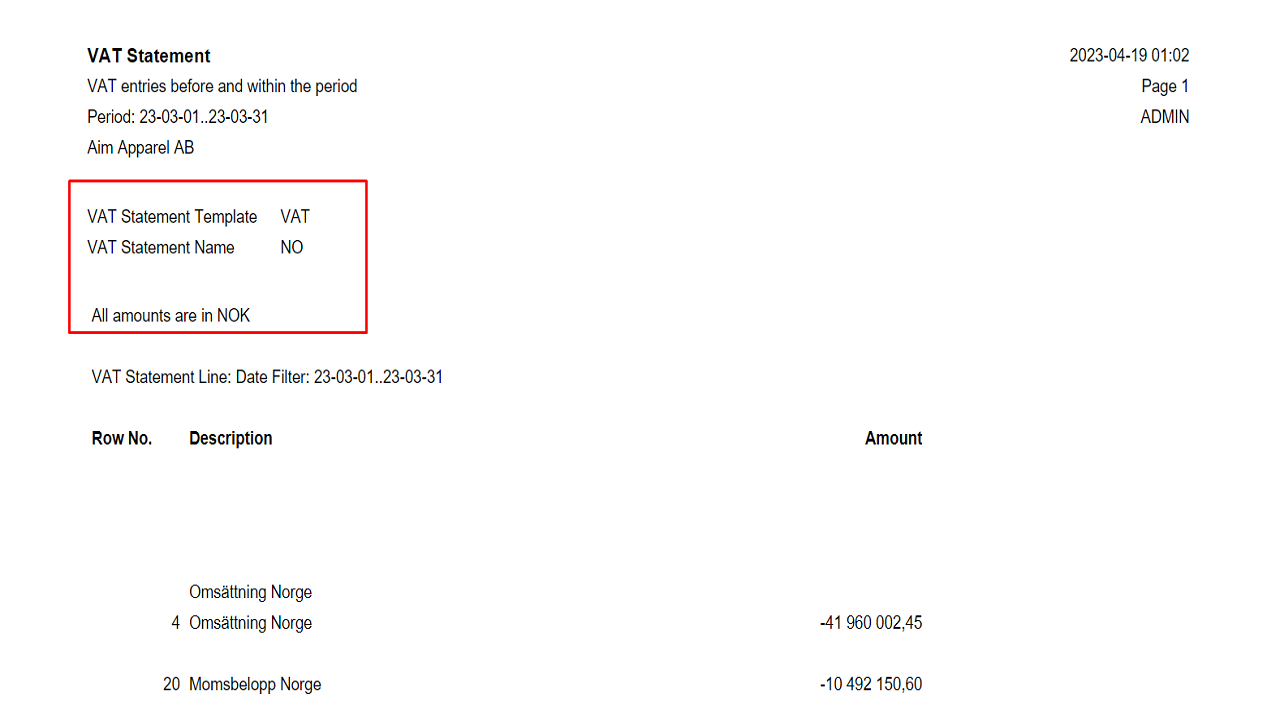

If your company is registered for VAT in multiple different countries, this App facilitates the reporting of VAT to those registered countries in ANY currency, from one legal entity within Business Central.

The Sales and Purchase transactions will be calculated and reported to the different Tax offices, regardless of your base currency and the original currencies of the transactions.

The app supports the Essentials and Premium Editions of Microsoft Dynamics 365 Business Central.

Supported Business Central Country versions to download and use this App: Australia, Belgium, Canada, Cyprus, Denmark, Estonia, Finland, France, Greece, Iceland, Ireland, Norway, Poland, Spain, Sweden, Germany, United Kingdom, United States

Supported Languages: This app is available in English (United States).

At a glance

Other apps from N3 Vision AB

PSP ConnectN3 Vision ABPSP Connect integrates with multiple Payment Providers such as Klarna, Adyen, Walley, PayPal & more.

+1

Applicable to: Business Central

Business Central

NaN out of 2

Giftcard ConnectN3 Vision ABGiftcard Connect integrates with multiple Gift Card Providers including AwardIT/Retain24 and Gifted

+1

Applicable to: Business Central

Business Central

NaN out of 2